September 19, 2023

A Health Savings Account offers a tax-favored way for eligible individuals (or their employers) to set aside funds to meet medical needs. Among the tax benefits: 1) contributions are deductible within limits; 2) earnings in the HSA aren’t taxed; 3) contributions an employer makes aren’t taxed; and 4) distributions to pay qualified expenses aren’t taxed. […]

September 12, 2023

Have your investments fluctuated wildly this year? You may have already recognized gains and losses. But nothing is decided tax-wise until all the gains and losses from 2023 trades are tallied up at year end. If you’ve had swings in the value of a tax-favored 401(k), traditional IRA, Roth IRA or SEP, there are no […]

September 5, 2023

Now that Labor Day has passed, the holidays are just around the corner. Many people may want to make gifts of cash or stock to their loved ones. By properly using the annual exclusion, gifts to family members and loved ones can reduce the size of your taxable estate, within generous limits, without triggering any […]

August 29, 2023

Many homeowners across the country have seen their home values increase in recent years. According to the National Association of Realtors, the median price of existing homes sold in July of 2023 rose 1.9% over July of 2022 after a couple years of much higher increases. The median home price was $467,500 in the Northeast, […]

August 22, 2023

If your employer provides life insurance, you probably find it to be a desirable fringe benefit. However, if group term life insurance is part of your benefits package, and the coverage is higher than $50,000, there may be undesirable income tax implications. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 […]

August 8, 2023

August 1, 2023

An estimated 190 million Americans have recently been under heat advisory alerts, according to the National Weather Service. That may have spurred you to think about making your home more energy efficient — and there’s a cool tax break that may apply. Thanks to the Inflation Reduction Act of 2022, you may be able to […]

July 25, 2023

More than a million Americans live in nursing homes, according to various reports. If you have a parent entering one, you’re probably not thinking about taxes. But there may be tax consequences. Let’s take a look at five possible tax breaks. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and […]

July 18, 2023

If you’re age 50 or older, you can probably make extra “catch-up” contributions to your tax-favored retirement account(s). It is worth the trouble? Yes! Here are the rules of the road. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and managing partner July 1, 2015. He serves as the manager […]

July 12, 2023

Are you planning your estate or have you inherited assets recently? You may not know the “basis” of assets for tax purposes. Under the current rules (known as the “step-up” rules), an heir receives a basis in inherited property equal to its date-of-death value. For example, if your grandmother paid $600 for stock in 1940 […]

July 5, 2023

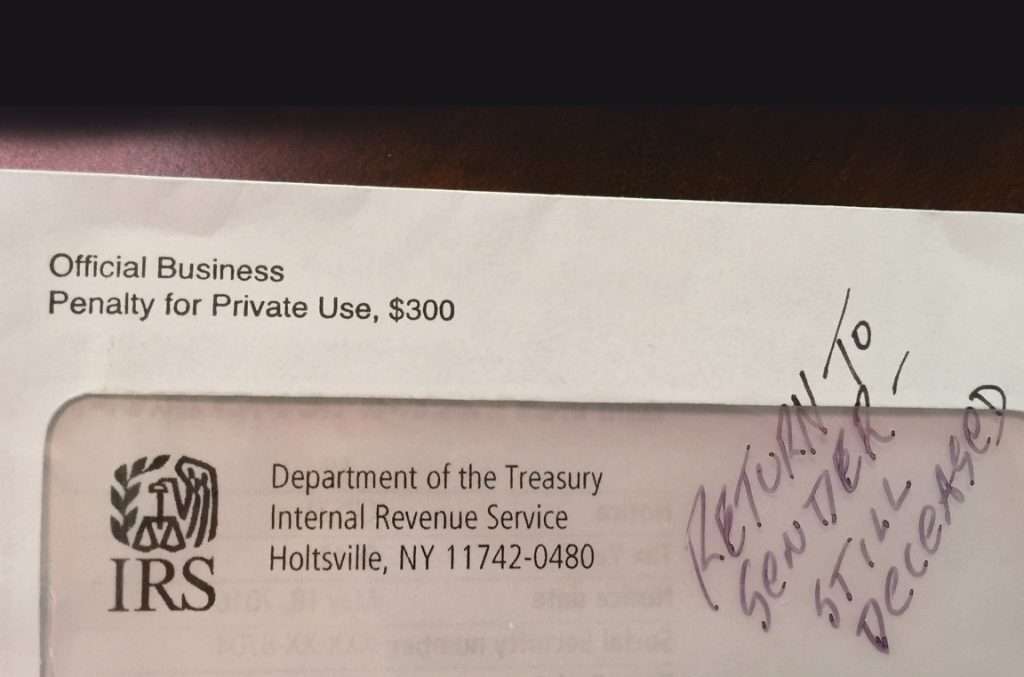

“Thousands of people have lost millions of dollars and their personal information to tax scams,” according to the IRS. The scams may come in through email, text messages, telephone calls or regular mail. Criminals regularly target both individuals and businesses and often prey on the elderly. Important: The IRS will never contact you by email, […]

June 30, 2023

The IRS recently released audit statistics for fiscal year 2022 and few taxpayers had their returns examined. Overall, just 0.49% of individual returns were audited. Historically, this is very low. However, even though a small percentage of returns are being audited these days, that will be little consolation if yours is one of them. Plus, […]

June 21, 2023

If one spouse in a married couple doesn’t earn compensation, the couple may not be able to save as much as they need for retirement. An IRA contribution is generally only allowed if you earn compensation. But an exception exists. A spousal IRA allows a contribution for a spouse who doesn’t earn compensation. For 2023, […]

June 14, 2023

If you’re age 65 and older and have basic Medicare insurance, you may need to pay additional premiums to get the level of coverage you want. The premiums can be costly, especially for married couples with both spouses paying them. But there may be an advantage: You may qualify for a tax break for paying […]

May 30, 2023

If you have significant assets, you should consider establishing a living trust to avoid probate. Probate is the legal process intended to make sure a deceased person’s assets are properly distributed. However, going through probate typically means red tape, legal fees and your financial affairs becoming public information. You can avoid this with a living […]

May 23, 2023

In recent years, many workers have become engaged in the “gig” economy. They may deliver takeout restaurant meals, walk dogs, drive for ride-hailing companies or even perform services such as nursing. There are tax consequences when performing these jobs. Generally, if you receive income from gigs or freelancing, it’s taxable. That’s true even if the […]

May 16, 2023

Are you getting ready to retire? If so, you’ll soon experience changes that may have tax implications. For example, if you sell your principal residence to downsize and you have a gain from the sale, you may be able to exclude up to $250,000 of the gain from your income ($500,000 if filing jointly). You […]

May 10, 2023

May 2, 2023

If you itemize deductions on your tax return, you may wonder: What medical expenses can I include? The IRS recently issued some frequently asked questions addressing when certain costs are qualified medical expenses for federal income tax purposes. For example, the costs of over-the-counter (non-prescription) drugs generally don’t count as qualified medical expenses. However, the […]

April 25, 2023

Two developments for crypto users and investors: 1) Taxpayers must now check a box on their returns indicating whether they received digital assets as payment for property or services or whether they sold, exchanged or transferred digital assets that were held as capital assets. If “yes” is checked, taxpayers must report income related to the […]

April 18, 2023

Have you inherited assets or are you planning your estate? You may not understand how tax “basis” works. Under the tax code “step-up” rules, an heir receives a basis in inherited property equal to its date-of-death value. For example, if your grandfather paid $500 for shares of an oil stock in 1940 and it’s worth […]

April 11, 2023

Once you file your 2022 tax return, you may wonder what tax papers you can throw away. You may have to produce records if the IRS audits your return. It’s a good idea to keep the actual returns indefinitely. But what about supporting records such as receipts and canceled checks? In general, except in cases […]

April 4, 2023

If you’re an art collector, you may wonder about the tax breaks available for donating a work of art to charity. Several different tax rules may come into play. Your deduction for a charitable contribution of art is subject to be reduced if the charity’s use of it is unrelated to the purpose or function […]

March 28, 2023

When preparing your tax return, we’ll check one of the following statuses: Single, married filing jointly, married filing separately, head of household (HOH) or qualifying widow(er). Filing as HOH is more favorable than filing as single. For example, the 2023 HOH standard deduction is $20,800 while it’s $13,850 for singles. To be eligible, you must […]

March 21, 2023

April 18 is the deadline for filing your 2022 tax return. But a couple other tax deadlines are coming up and they’re important for certain taxpayers: 1) April 1 is the last day to begin receiving required minimum distributions (RMDs) from IRAs, 401(k)s and similar workplace plans for taxpayers who turned 72 during 2022. 2) […]

March 14, 2023

Did you make large gifts to your children, grandchildren or other heirs last year? If so, it’s important to determine whether you’re required to file a gift tax return by April 18 (Oct. 16 if you file for an extension). The annual gift tax exclusion has increased in 2023 to $17,000 but was $16,000 for […]

March 7, 2023

February 28, 2023

You generally must pay federal tax on all income you receive but there are some exceptions. For example, compensatory awards and judgments for “personal physical injuries or physical sickness” are free from federal income tax under the tax code. This includes amounts received in a lawsuit or a settlement and in a lump sum or […]

February 21, 2023

If you’re getting ready to file your 2022 tax return, and your tax bill is higher than you’d like, there might still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until this year’s April 18 filing deadline and benefit from the tax […]

February 15, 2023

Over the years, the Child Tax Credit (CTC) rules have changed significantly. For 2022 and 2023, the CTC applies to taxpayers with children under the age of 17 (who meet certain other requirements). The CTC is currently $2,000 for each qualifying child. A $500 credit for other dependents is available for dependents other than qualifying […]

February 7, 2023

Many people are more concerned about their 2022 tax bills than they are about their 2023 tax situations. That’s because 2022 individual tax returns are due to be filed in 10 weeks. However, it’s a good time to acquaint yourself with tax amounts for this year, many of which have increased substantially due to inflation. […]

January 31, 2023

Many people are more concerned about their 2022 tax bills than they are about their 2023 tax situations. That’s because 2022 individual tax returns are due to be filed in 10 weeks. However, it’s a good time to acquaint yourself with tax amounts for this year, many of which have increased substantially due to inflation. […]

January 24, 2023

The IRS opened the 2023 individual income tax return filing season on Jan. 23. Even if you usually don’t file until closer to the mid-April deadline (or you file an extension), you may want to file early. It can potentially protect you from tax identity theft. In these scams, a thief uses another person’s personal […]

January 17, 2023

January 10, 2023

If you’re a parent with college-bound children, you may want to save for future college costs. There may be tax-favored ways to save. For example, 529 plans allow you to make contributions to an account set up to meet a child’s education expenses. Contributions aren’t deductible and are treated as taxable gifts to the child. […]

January 3, 2023

The SECURE 2.0 Act, which was signed into law on Dec. 29, 2022, will help many Americans save more for retirement. However, many of the provisions don’t kick in for a few years. One provision that does take effect this year is an increase in the age for beginning required minimum distributions (RMDs). Employer-sponsored qualified […]

December 27, 2022

December 20, 2022

Does your employer offer a 401(k) plan? If so, contributing to it is a wise way to build a substantial nest egg. If you’re not already contributing the maximum allowed, consider increasing the amount. With a 401(k), an employee elects to have a certain amount of pay deferred and contributed by an employer on his […]

December 13, 2022

Are you thinking about selling stock at a loss to offset gains that have been realized during 2022? If so, it’s important to be careful of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before […]

December 6, 2022

November 29, 2022

As year-end approaches, you may want to make some moves to make the best tax use of paper losses and actual losses from your stock market investments. For example, have you realized gains earlier in 2022 from sales of stock held for more than one year (long-term capital gains) or from sales of stock held […]

November 22, 2022

The holiday season is here and many people plan to donate to their favorite charities before the end of the year. In 2022, in order to receive a charitable donation write-off, you must itemize deductions on your tax return. What if you want to give gifts of investments? Don’t give away stock in taxable accounts […]

November 15, 2022

If you own savings bonds, you may wonder: How is the interest taxed? EE bonds don’t pay interest currently. Instead, accrued interest is reflected in their redemption value. (But owners can elect to have interest taxed annually.) Series I savings bond interest is based on inflation. Series I bond owners may either: 1) Defer reporting […]

November 8, 2022

Two tax benefits are available to offset the expenses of adopting a child. In 2022, adoptive parents can claim a credit against their federal tax for up to $14,890 of “qualified adoption expenses” for each eligible child. This will increase to $15,950 in 2023. That’s a dollar-for-dollar reduction of tax. Also, parents may be able […]

November 1, 2022

The IRS recently announced next year’s inflation-adjusted tax amounts. For 2023, the standard deduction will increase to $13,850 for single taxpayers, $27,700 for married couples filing jointly and $20,800 for heads of household. This is up from the 2022 amounts of $12,950 for singles, $25,900 for married couples filing jointly and $19,400 for heads of […]

October 25, 2022

You’ve probably heard of the “nanny tax.” But even if you don’t employ a nanny, it may apply to you. Hiring a house cleaner or other household employee (who isn’t an independent contractor) may make you liable for federal income tax, Social Security and Medicare (FICA) tax and federal unemployment tax. You may also have […]

October 18, 2022

Are you feeling generous this year? Taxpayers can transfer large amounts free of gift taxes to loved ones each year with the proper use of the annual exclusion. For 2022, the exclusion amount is $16,000. The exclusion covers gifts that an individual makes to each recipient each year. So a taxpayer with three children can […]

October 11, 2022

If you’re interested in investing in tax-free municipal bonds, you may wonder if there are any tax consequences. In general, interest received on tax-free municipal bonds isn’t included in gross income for federal (and possible state) tax purposes. However, it may be included for alternative minimum tax purposes. Keep in mind that a municipal bond […]

October 4, 2022

If you have a child or grandchild who’s heading to college in the future, you may wonder about investing in a qualified tuition program or 529 plan. You don’t get a federal tax deduction for a contribution, but the earnings aren’t taxed while the funds are in the program. (There may be a state deduction […]

September 27, 2022

It’s time to think about steps to lower your tax bill for this year and next. If you itemize deductions, you may be able to deduct medical expenses, state and local taxes up to $10,000, charitable donations and eligible mortgage interest. But these deductions won’t save taxes unless they’re more than your standard deduction ($25,900 […]

September 20, 2022

The current federal estate tax exemption ($12.06 million in 2022) means that many people aren’t concerned with estate tax. But they should still plan to save income taxes. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But […]

September 13, 2022

The National Association of Realtors reports that July 2022 existing home sales were down but prices were up nationwide, compared with 2021. If you’re a homebuyer, you may wonder if you can deduct mortgage points paid on your behalf by the seller. The answer is “yes,” subject to some important limits. For example, the rule […]

September 6, 2022

High-income taxpayers may face the 3.8% net investment income tax (NIIT). The NIIT applies, in addition to income tax, on your net investment income. It only affects taxpayers with adjusted gross income exceeding $250,000 for joint filers, $200,000 for single taxpayers and heads of household, and $125,000 for married individuals filing separately. The income that’s […]

August 30, 2022

The Inflation Reduction Act (IRA), which was signed into law recently, contains, extends and modifies many climate and energy-related tax credits. For example, there’s a credit for a percentage of certain expenses for nonbusiness energy-saving property placed in service before Jan. 1, 2033. The credit is further increased for amounts spent for a home energy […]

August 23, 2022

If you’re a business owner working from home or an entrepreneur with a side gig, you may qualify for home office deductions. On the other hand, employees who work remotely can’t deduct home office expenses under current federal tax law. To qualify for a deduction, you must use part of your home regularly and exclusively […]

August 16, 2022

When a married couple files a joint tax return, each spouse is liable for the full amount of tax on the couple’s combined income. Therefore, the IRS can come after either spouse to collect the entire tax, (not just the part that’s attributed to that spouse). This includes any tax deficiency that the IRS assesses […]

August 9, 2022

You may have to make estimated payments if you receive interest, dividends, self-employment income, capital gains or other income. If you don’t pay enough tax during the year through withholding and estimated payments, you may be liable for a tax penalty on top of the tax that’s due. Individuals must generally pay 25% of their […]

August 3, 2022

When you filed your federal tax return this year, were you surprised to find you owed money? Or did you wind up getting a large refund? Either situation might mean it’s time to review and adjust your withholding. This might be necessary because something in your life is different this year (for example, you got […]

July 26, 2022

If you take withdrawals from your traditional IRA, you probably know they’re taxable. But there may be an additional penalty tax on “early” withdrawals. An early distribution is defined as taken before age 59½. You’ll be hit with a 10% penalty tax unless an exception applies. Fortunately, there are several exceptions. Common examples include: 1) […]

July 19, 2022

July 12, 2022

Many people are thinking about buying electric vehicles because of their advanced technology, high gas prices and the fact there are more models available today. Along with factors like acceleration and the battery range, check out the federal tax break that may be available. About the Author Latest PostsAbout James B. ReynoldsJim became a partner […]

July 5, 2022

How is disability income taxed? The answer is: It depends on who paid for the benefit. If the income is paid directly to you by your employer, it’s taxable to you just as ordinary salary would be. Frequently, the payments aren’t made by an employer but by an insurance company under a policy providing disability […]

June 28, 2022

Individuals can deduct vehicle-related expenses in certain circumstances. Unfortunately, under current law, you may not be able to deduct as much as you could years ago. For 2018 through 2025, business and moving miles are deductible only in limited circumstances. Fortunately, if you’re eligible to deduct driving costs, the IRS recently increased the standard amounts […]

June 22, 2022

Are you getting divorced? In addition to the tough personal issues you’re dealing with, tax concerns should be addressed to keep taxes to a minimum. For example, if you sell your personal residence or one spouse remains there while the other moves out, you want to make sure you’ll be able to avoid tax on […]

June 14, 2022

The current federal estate tax exemption ($12.06 million in 2022) means that many people aren’t concerned with estate tax. But they should still plan to save income taxes. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But […]

June 7, 2022

If you’ve begun receiving Social Security benefits, you may wonder: Will my benefits be taxed? It depends on your other income. If you’re taxed, up to 85% of your payments could be hit with federal income tax. If you file a joint tax return and your “provisional income,” plus half your Social Security benefits, isn’t […]

May 31, 2022

The stock market downturn has caused the value of some retirement accounts to decrease. But if you have a traditional IRA, a downturn may provide a valuable opportunity: It may allow you to convert to a Roth IRA at a lower tax cost. Roth IRA qualified withdrawals are tax free and you don’t have to […]

May 24, 2022

Do you have Series EE savings bonds purchased years ago? You may wonder how the interest is taxed. EE bonds don’t pay interest currently. Instead, accrued interest is reflected in their redemption value. (Owners can elect to have interest taxed annually.) EE bond interest isn’t subject to state income tax. And using the money for […]

May 17, 2022

Are you charitably minded? If you’re 70½ or older, you may want to consider making a cash donation to a qualified charity out of your IRA. When distributions are taken out of traditional IRAs, federal income tax (and possibly state tax) must be paid. One way to transfer IRA assets to charity is via a […]

May 10, 2022

Taking care of an elderly parent or relative may provide more than just satisfaction. You could also be eligible for tax breaks. For example, if the individual qualifies as your “medical dependent,” and you itemize deductions on your return, you can include any medical expenses you incur for the relative along with your own when […]

May 3, 2022

If you donate valuable items to charity, you may be required to get an appraisal. The IRS requires donors and charitable organizations to supply certain information to prove their right to deduct charitable contributions. If you donate an item of property (or a group of similar items) worth more than $5,000, certain appraisal requirements apply. […]

April 26, 2022

You may dream of turning a hobby into a business. You won’t have any tax headaches if your new business is profitable. But what if the enterprise consistently generates losses (deductions exceed income) and you claim them on your tax return? The IRS may step in and say it’s a hobby (an activity not engaged […]

April 19, 2022

Some taxpayers move to new homes but rent out their present homes. Renting out a home carries potential tax benefits and pitfalls. You’re generally treated as a landlord once you begin renting your home. That means you must report rental income on your tax return but are entitled to deductions for utilities, incidental repairs, depreciation […]

April 12, 2022

After filing a 2021 tax return, keep these three issues in mind: 1) You can check on your refund by going to irs.gov. Click on “Get Your Refund Status.” 2) Some tax records can now be thrown out. You should generally save statements, receipts, etc. for three years after filing (those related to the 2018 […]

April 5, 2022

For tax purposes, the rules involved in selling mutual fund shares can be complex. If you sell appreciated fund shares that you’ve owned for more than one year, the profit will be a long-term capital gain. The top federal income tax rate will be 20% and you may also owe the 3.8% net investment income […]

March 29, 2022

March 22, 2022

What are the tax consequences of renting out a vacation home part of the year? It depends on how many days it’s rented and your level of personal use. Personal use includes vacation use by your relatives and use by nonrelatives if market rate rent isn’t charged. If you rent the property for less than […]

March 15, 2022

“Income in respect of a decedent” (IRD) may create a surprise tax bill for those who inherit certain types of property. Fortunately, there may be ways to minimize or even eliminate the IRD tax bite. For the most part, property you inherit isn’t included in your income for tax purposes. Items that are IRD, however, […]

March 8, 2022

If you’re laid off or terminated, taxes are probably the last thing on your mind. However, there may be tax implications. For example, what’s the best option for amounts you’ve accumulated in a retirement plan sponsored by a former employer? For most, a tax-free rollover to an IRA is the best move. You may continue […]

March 1, 2022

To help ensure financial security in retirement, saving now on a tax-favored basis is a smart move. And if you qualify, you still have time to contribute to an IRA or SEP and save on your 2021 tax return. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and managing partner […]

February 22, 2022

If you made large gifts to your children, grandchildren or others in 2021, it’s important to determine whether you’re required to file a gift tax return by April 18 (Oct. 17 if you file for an extension). The annual gift tax exclusion has increased in 2022 to $16,000 but was $15,000 for 2021. Generally, you’ll […]

February 15, 2022

If you’re married, you may wonder if you should file joint or separate tax returns. It depends on your individual tax situation. In general, you should use the filing status that results in the lowest tax. But keep in mind that, if you and your spouse file a joint return, each of you is “jointly […]

February 8, 2022

To claim a tax deduction for a donation of $250 or more, you generally need a contemporaneous written acknowledgment from the charity. “Contemporaneous” means you receive it by the date you file your return, or the extended due date of the return. If you made a donation in 2021 but don’t have a letter from […]

February 1, 2022

Traditional and Roth IRAs can help you save for retirement on a tax-favored basis. Contributions to a traditional IRA reduce your current tax bill, if you’re eligible, and earnings are tax-deferred. However, withdrawals are taxed in full (plus a 10% penalty if taken before age 59½, unless an exception applies). Roth IRA contributions aren’t deductible. […]

January 25, 2022

The IRS began accepting 2021 individual returns on Jan. 24. Here are three quick tips to help speed processing and avoid hassles this tax season. 1) Contact us soon for an appointment to prepare your return. 2) Gather all documents needed to prepare an accurate return. This includes W-2 and 1099 forms. In addition, you […]

January 18, 2022

The IRS is opening the 2021 individual income tax return filing season on Jan. 24. Even if you usually don’t file until closer to the April deadline (or you file an extension), consider filing early. It can potentially protect you from tax identity theft. In these scams, a thief uses another person’s personal information to […]

January 11, 2022

While Congress didn’t pass the Build Back Better Act in 2021, there are still tax changes that may affect your tax situation for this year. That’s because some tax figures are adjusted annually for inflation. It’s a good idea to familiarize yourself with tax amounts that have changed for this year. For example, the amount […]

January 4, 2022

You may pay out a bundle in out-of-pocket medical costs. But can you deduct them on your tax return? It’s possible but not easy. Medical expenses can be deducted only to the extent unreimbursed costs exceed 7.5% of your adjusted gross income. Plus, medical expenses are deductible only if you itemize, which means that your […]

January 3, 2022

Many employees receive part of their compensation from sales-related commissions. Unfortunately, some of these workers occasionally may be tempted to abuse the commission system by falsifying sales or rates. Generally, this takes one of three forms: 1) invented sales, 2) overstated sales and 3) manipulated commission rates. This last scheme often involves the collusion of […]

December 28, 2021

Many people have become gig workers to earn extra money through online platforms. Find out more about the tax implications of these jobs. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and managing partner July 1, 2015. He serves as the manager of the Firm’s Accounting and Auditing Department and […]

December 21, 2021

If you’re paying back college loans for yourself or your children, you may wonder if you can deduct the interest you pay. The answer is yes, subject to certain limits. The maximum amount of student loan interest you can deduct annually is $2,500. The deduction is phased out if your adjusted gross income (AGI) exceeds […]

December 14, 2021

Year-end is a good time to plan to save taxes by structuring your capital gains and losses. Consider some possibilities. For example, suppose you lost money this year on some stock and have other stock that has appreciated. Consider selling appreciated assets before Dec. 31 (if you think the value has peaked) and offset gains […]

December 7, 2021

Awards and settlements are paid for many reasons. For example, a person could receive payments for personal injury or discrimination. By law, individuals can exclude from gross income damages that are received on account of personal physical injury or physical sickness. For purposes of this exclusion, emotional distress isn’t considered physical injury or sickness. So, […]

December 2, 2021

You may still have time to trim your 2021 federal tax liability by taking certain steps. For example, contribute the maximum to your retirement plans, including traditional IRAs and SEP plans. Another idea: If you make your Jan. 2022 mortgage payment in December, you can deduct the interest portion on your 2021 tax return (assuming […]

November 23, 2021

The Infrastructure Investment and Jobs Act was signed into law on Nov. 15, 2021. It includes new reporting requirements that will generally apply to digital asset transactions starting in 2023. Cryptocurrency exchanges will be required to perform intermediary Form 1099 reporting for crypto transactions. The law expands the definition of brokers who must furnish Forms […]

November 16, 2021

Do you have a tax-saving flexible spending account (FSA) with your employer to help pay for health or dependent care expenses? It’s a good time to review 2021 expenses and project amounts to be set aside for 2022. A pre-tax contribution of $2,750 to a health FSA is permitted in 2021. This is increasing to […]

November 9, 2021

Planning to donate to charity this year? Normally, if you take the standard deduction and don’t itemize, you can’t claim a deduction for charitable gifts. But for 2021, you’re allowed to claim a limited deduction for cash contributions made to qualifying charities. For cash donations made this year, you can deduct up to $300 ($600 […]

November 2, 2021

October 26, 2021

Interested in participating in a 401(k) plan offered by your employer? Under a 401(k), you have the option of setting aside a certain amount of your wages in a qualified retirement plan. By making this election, you’ll reduce your gross income, and defer tax on the amount until the cash (adjusted by earnings) is distributed […]

October 19, 2021

Have you heard of the “nanny tax?” Even if you don’t employ a nanny, it may apply to you. Hiring a house cleaner or other household employee (who isn’t an independent contractor) may make you liable for federal income tax, Social Security and Medicare (FICA) tax and federal unemployment tax. You may also have state […]

October 13, 2021

If you own a vacation home, you may want to rent it out for part of the year. The tax treatment can be complex. It depends on how many days it’s rented and your level of personal use. Personal use includes vacation use by you, certain relatives and nonrelatives if market rent isn’t charged. However, […]

October 5, 2021

One or more substantiation rules may apply when donating art. First, if you claim a deduction of less than $250, you must get and keep a receipt from the organization and keep written records for each item contributed. If you claim a deduction of $250 to $500, you must get and keep an acknowledgment of […]

September 28, 2021

Studies find that more people are gambling online and sports betting. And there are still more traditional ways to gamble. If you’re lucky enough to win, tax consequences go along with your good fortune. You must report 100% of your winnings as taxable income. If you itemize deductions, you can deduct losses but only up […]

September 21, 2021

For eligible individuals, a Health Savings Account (HSA) offers a tax-favorable way to set aside funds (or have an employer do so) to meet future medical needs. Some of the tax benefits: 1) Contributions are deductible, within limits; 2) Earnings on the funds in the HSA aren’t taxed; 3) Contributions an employer makes aren’t taxed […]

September 14, 2021

Many people have seen their home values increase recently. Be aware of the tax implications if you sell your home. If you’re selling your principal residence, you can exclude up to $250,000 ($500,000 for joint filers) of gain, if you meet certain requirements. For example, you must have owned the property for at least 2 […]

September 7, 2021

As we approach the end of the year, many people may want to make gifts of cash or stock to their loved ones. By properly using the annual exclusion, gifts can reduce the size of your taxable estate, within generous limits, without triggering any estate or gift tax. The exclusion amount for 2021 is $15,000. […]

September 1, 2021

In recent weeks, some Americans have been victimized by severe storms, flooding, wildfires and other disasters. Unexpected disasters may cause damage to your home or personal property. The rules for deducting personal casualty losses on a tax return have changed through 2025. Specifically, taxpayers generally can’t deduct losses unless an event qualifies as a federally […]

August 24, 2021

Employer-provided life insurance is a coveted fringe benefit. However, if group term life insurance is part of your benefit package, and the coverage is higher than $50,000, there may be undesirable income tax implications. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add […]

August 17, 2021

There may be a tax-advantaged way for people to save for the needs of family members with disabilities, without having them lose eligibility for their government benefits. It’s done though an ABLE account, which is a tax-free account that can be used for disability-related expenses. Eligible individuals must have become blind or disabled before turning […]

August 10, 2021

If your child is fortunate enough to be awarded a scholarship, you may wonder about the tax implications. Scholarships and fellowships are generally (but not always) tax free for students at elementary, middle and high schools, as well as those attending college, graduate school or accredited vocational schools. It doesn’t matter if the scholarship makes […]

July 27, 2021

If you have student loan debt, you may wonder if you can deduct the interest you pay. The answer is yes, subject to certain limits. However, the deduction is phased out if your adjusted gross income exceeds certain levels. The maximum amount of student loan interest you can deduct per year is $2,500. For 2021, […]

July 21, 2021

If you’re planning your estate, or you’ve inherited assets, you may not know the “basis” for tax purposes. Under the current rules (known as the “step-up” rules), an heir receives a basis in inherited property equal to its date-of-death value. For example, if your grandmother paid $500 for stock in 1935 and it’s worth $1 […]

July 13, 2021

Do you have significant investment-related expenses, including subscription costs and home office expenses? Under current tax law, these expenses aren’t deductible through 2025 if they’re considered investment expenses for the production of income. But they’re deductible if they’re considered trade or business expenses. The U.S. Tax Court has developed a 2-part test that must be […]

July 6, 2021

The IRS just released audit statistics for the 2020 fiscal year and fewer taxpayers had their returns examined compared with prior years. Overall, just 0.5% of individual returns were audited. Historically, this is very low. However, even though a small percentage of returns are being audited these days, that will be little consolation if yours […]

June 29, 2021

Married couples may not be able to save as much as they need for retirement when one spouse doesn’t work outside the home. An IRA contribution is generally only allowed if you earn compensation. But an exception exists. A spousal IRA allows a contribution for a nonworking spouse. For 2021, a couple can contribute $6,000 […]

June 22, 2021

Are you age 65 and older and have basic Medicare insurance? You may need to pay additional premiums to get the level of coverage you want. The premiums can be expensive, especially if you’re married and both you and your spouse are paying them. But there may be a bright side: You may qualify for […]

June 15, 2021

If you’re a parent with a college-bound child, you may want to save with tax-favored vehicles. For example, if used to finance college, eligible families don’t have to report the interest on Series EE U.S. savings bonds for federal tax purposes until the bonds are cashed in. And interest on “qualified” Series EE (and Series […]

June 8, 2021

If you’re getting ready to retire, you’ll soon experience changes that may have tax implications. For example, if you sell your principal residence to downsize and you have a gain from the sale, you may be able to exclude up to $250,000 of the gain from your income ($500,000 if filing jointly). You may have […]

June 2, 2021

High-income taxpayers face a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. The NIIT applies only if modified adjusted gross income (MAGI) exceeds: $250,000 for married taxpayers filing jointly and surviving spouses; $125,000 for married taxpayers filing separately; and $200,000 for unmarried taxpayers and heads of household. The amount […]

May 26, 2021

Eligible parents will soon receive payments from the federal government by direct deposit, paper check or debit card. The IRS announced that the 2021 advance child tax credit (CTC) payments, which were created in the American Rescue Plan Act, will begin July 15, 2021, and run through Dec. 15, 2021. Payments will get up to […]

May 19, 2021

After filing a tax return, you may have questions. 1) When will you receive your refund? Go to irs.gov and click on “Get Your Refund Status” to find out. 2) How long should you save tax records? In general, save records for three years after filing although you should keep the actual returns indefinitely. However, […]

May 11, 2021

Before the pandemic hit, the number of people engaged in the “gig” or sharing economy was growing. And even more people turned to gig work during the pandemic to make up lost income. There are tax consequences for the people who perform these jobs. Generally, if you receive income from gigs or freelancing, it’s taxable. […]

May 4, 2021

This year, the deadline for filing 2020 individual tax returns is May 17, 2021. The April 15 due date was postponed due to the pandemic. If you still aren’t ready to file, request a tax-filing extension. Anyone can request an automatic extension with IRS Form 4868. This extends the filing deadline until Oct. 15, 2021. […]

April 27, 2021

The May 17 deadline for filing your 2020 individual tax return is coming up. It’s important to file and pay your tax return on time to avoid penalties imposed by the IRS. Here are the basic rules. Separate penalties apply for failing to pay and failing to file. The failure-to-pay penalty is 1/2% for each […]

April 20, 2021

Many people lost their jobs last year due to pandemic shutdowns. Generally, unemployment compensation is included in gross income for federal tax purposes. But thanks to the American Rescue Plan Act (ARPA), enacted on March 11, 2021, up to $10,200 of unemployment compensation can be excluded from federal gross income on 2020 federal returns for […]

April 13, 2021

If you’re buying or selling a home, you should know how to determine your basis. The law allows an exclusion from income for all or part of the gain realized on your home sale. The general exclusion limit is $250,000 ($500,000 for married taxpayers). You want your basis to be as high as possible in […]

April 6, 2021

When you file your tax return, you must check one of the following filing statuses: Single, married filing jointly, married filing separately, head of household or qualifying widow(er). Who qualifies to file as a head of household, which is more favorable than single? To qualify, you must maintain a household, which for more than half […]

March 30, 2021

If you have a life insurance policy, you may want to ensure that the benefits your family will receive after your death won’t be included in your estate. That way, the benefits won’t be subject to federal estate tax. For 2021, the federal estate and gift tax exemption is $11.7 million ($23.4 million for married […]

March 23, 2021

The new American Rescue Plan Act provides eligible families with an enhanced child and dependent care credit for 2021. This is the credit for expenses paid for the care of qualifying children under the age 13 so the taxpayer can be gainfully employed. For 2021, the first $8,000 of care expenses generally qualifies for the […]

March 16, 2021

President Biden has signed the American Rescue Plan Act into law. Among the many relief provisions are direct payments that will be made to eligible individuals. The full amount for eligible individuals is $1,400 ($2,800 for eligible married couples filing joint tax returns) plus $1,400 for each dependent. Most eligible taxpayers will receive direct bank […]

March 10, 2021

April 15 is not only the deadline for filing your 2020 tax return, it’s also the deadline for the first estimated tax payment for 2021. You may have to make estimated payments if you receive interest, dividends, self-employment income, capital gains or other income. If you don’t pay enough tax during the year through withholding […]

March 2, 2021

If you’re approaching retirement, you probably want to ensure the money you’ve saved in retirement plans lasts as long as possible. If so, be aware that a law was enacted in late 2019 that made significant changes to retirement accounts. For example, the SECURE Act repealed the maximum age for making traditional IRA contributions. Before […]

February 23, 2021

February 16, 2021

To claim a deduction for a donation of $250 or more, you generally need a contemporaneous written acknowledgment from the charity. “Contemporaneous” means the earlier of the date you file your income tax return, or the extended due date of your return. If you made a donation in 2020 but don’t have a written acknowledgment, […]

February 9, 2021

For 2021, you can contribute up to $19,500 (unchanged from 2020) to a 401(k) or 403(b) plan. You can make an additional $6,500 catch-up contribution if you’re age 50 or older. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and managing partner July 1, 2015. He serves as the manager […]

February 3, 2021

Although electric vehicles are a small percentage of the cars on the road today, they’re increasing in popularity. And if you buy one, you may be eligible for a federal tax break. The tax code provides a credit to purchasers of qualifying plug-in electric drive motor vehicles including passenger cars and light trucks. The credit […]

January 26, 2021

If you have a traditional IRA or tax-deferred retirement plan account, you probably know that you must take required minimum distributions (RMDs) when you reach a certain age. Once you attain age 72 (or age 70½ before 2020), you must begin taking RMDs from traditional IRAs and certain retirement accounts. If you don’t withdraw the […]

January 19, 2021

The IRS is opening the 2020 individual income tax return filing season on Feb. 12. (This is later than in the past because of a law that was recently enacted.) Even if you usually don’t file until closer to the April 15 deadline (or you file an extension), consider filing early. It can potentially protect […]

January 14, 2021

If you or your child attends (or plans to attend) college, you may be eligible for tax breaks to help foot the bill. The new Consolidated Appropriations Act made some changes. The law repeals the Tuition and Fees Deduction for 2021 and later years. In addition, for 2021 and beyond, the new law aligns the […]

January 5, 2021

The COVID-19 relief law that was signed recently contains many provisions that may affect you. The law provides for direct payments of $600 per eligible individual ($1,200 for a married couple filing jointly), plus $600 per qualifying child. The government has already started making bank direct deposits or mailing checks. Another provision extends a charitable […]

December 31, 2020

Dishonest workers can initiate a cyberattack by stealing valuable information from your company’s computer network and using it for personal gain. They could be working for a competitor, seeking revenge for perceived wrongs or they may need money to pay gambling debts. You can prevent insider cybercrime by monitoring IT use, removing network access as […]

December 29, 2020

December 22, 2020

If you’re self-employed and don’t have paycheck withholding, you probably have to make estimated tax payments. These payments must be sent to the IRS on a quarterly basis. The 4th 2020 estimated tax payment deadline for individuals is Friday, Jan. 15. Even if you do have some withholding from paychecks or other payments, you may […]

December 15, 2020

Medical services and prescriptions are expensive. You may be able to deduct some expenses on your tax return but the rules make it difficult for many people to qualify. You may be able to time certain medical expenses to your tax advantage. For 2020, the medical expense deduction can only be claimed to the extent […]

December 8, 2020

Are you thinking about selling stock at a loss to offset gains that have been realized during 2020? If so, it’s important not to run afoul of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period […]

December 1, 2020

Are you thinking about selling stock at a loss to offset gains that have been realized during 2020? If so, it’s important not to run afoul of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period […]

November 24, 2020

Many employees save taxes by placing funds in their employer’s health or dependent care flexible spending arrangements (FSAs). It’s a good time to review 2020 expenditures and project amounts to be set aside for 2021. A pre-tax contribution of $2,750 to a health FSA is permitted in 2020. To avoid forfeiture of your health FSA […]

November 18, 2020

If you’ve built a nice nest egg in a traditional IRA (including a SEP or SIMPLE-IRA), it’s critical that you plan carefully for withdrawals from these tax-deferred retirement vehicles. For example, if you need to take money out of a traditional IRA before age 59½, distributions will generally be taxed and may also be subject […]

November 11, 2020

Many people have Series EE savings bonds that were purchased many years ago. Perhaps they were given as gifts or maybe you bought them yourself and filed them away. You may wonder: How is the interest taxed? EE bonds don’t pay interest currently. Instead, accrued interest is reflected in their redemption value. (But owners can […]

November 4, 2020

You may wonder if and how disability income is taxed. It depends on who paid for the benefit. If the income is paid directly to you by an employer, it’s taxable to you as ordinary salary would be. (Taxable benefits are also subject to federal tax withholding, although they may not be subject to Social […]

October 27, 2020

When a couple is going through a divorce, taxes are probably not foremost on their minds. But without proper planning, some people find divorce to be even more taxing. Several concerns should be addressed to ensure that taxes are kept to a minimum. For example, if you sell your principal residence or one spouse remains […]

October 20, 2020

If you’re planning to sell assets at a loss to offset gains that have been realized during the year, it’s important to be aware of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or […]

October 13, 2020

Oct. 15 is the deadline for individual taxpayers who extended their 2019 tax returns. If you’re finally done filing last year’s return, you might wonder: Which tax records can you toss once you’re done? Now is a good time to go through old tax records and see what you can discard. A common rule of […]

October 6, 2020

If you file a joint tax return with your spouse, you should be aware of your individual liability. And if you’re getting divorced, you should know that there may be relief available if the IRS comes after you for certain past-due taxes. When a married couple files jointly, each spouse is liable for the tax […]

September 29, 2020

The current federal estate tax exemption ($11.58 million in 2020) means that many people aren’t concerned with estate tax. But they should still plan to save income taxes. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But […]

September 22, 2020

In some cases, investors have related expenses, such as the cost of subscriptions to financial periodicals and clerical expenses. Are they tax deductible? Currently, they’re only deductible if you can show that your investment activities rise to the level of carrying on a trade or business. In that case, you may be considered a trader, […]

September 15, 2020

COVID-19 has resulted in many changes in our lives, and some of them have tax implications. For example, many employers have required employees to work from home. Unfortunately, employee business expense deductions (including expenses to maintain a home office) are disallowed from 2018 through 2025. However, if you’re self-employed and work from a home office, […]

September 9, 2020

Despite the pandemic, the National Association of Realtors reports that existing home sales and prices are up nationwide, compared with last year. If you’re a homebuyer, you may wonder if you can deduct mortgage points paid on your behalf by the seller. Yes, you can, subject to some important limitations. For example, the rule allowing […]

September 1, 2020

Despite the COVID-19 pandemic, students are going back to school this fall, either remotely, in-person or a combination. In any event, parents may be eligible for certain tax breaks to help defray the cost of education. For example, with the American Opportunity Tax Credit (AOTC), you can save a maximum of $2,500 for each full-time […]

August 25, 2020

If you’re getting close to retirement, you may wonder: Will my Social Security benefits be taxed? It depends on your other income. If you’re taxed, up to 85% of your payments could be hit with federal income tax. If you file a joint tax return and your “provisional income,” plus half your Social Security benefits, […]

August 19, 2020

August 11, 2020

Due to COVID-19, many parents are hiring nannies and babysitters because daycare centers and summer camps have closed. This may result in federal “nanny tax” obligations. You may be liable for federal income tax, Social Security and Medicare (FICA) tax and federal unemployment tax. (Even if you don’t employ a nanny, you may owe nanny […]

August 4, 2020

Does your employer provide you with group term life insurance? If so, and depending on the amount of coverage, this employee benefit may create undesirable income tax consequences for you. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income […]

July 28, 2020

If your child has been awarded a scholarship, congratulations! But be aware that there may be tax implications. Scholarships and fellowships are generally tax-free for students at elementary, middle and high schools, as well as those attending college, graduate school or accredited vocational schools. It doesn’t matter if the scholarship makes a direct payment to […]

July 21, 2020

If you’re planning your estate, or you’ve inherited assets, you may be unsure of the “cost” (or “basis”) for tax purposes. Under the fair market value basis rules (also known as the “step-up and step-down” rules), an heir receives a basis in inherited property equal to its date-of-death value. For example, if your grandfather bought […]

July 14, 2020

Did you recently file your tax return and receive a refund that was smaller than you were expecting? Or did you wind up owing additional tax when you filed your return? That might mean it’s time to check and adjust your withholding. This might be necessary due to changes in the Tax Cuts and Jobs […]

July 7, 2020

June 30, 2020

Economic Impact Payments (EIPs) are being sent to eligible individuals in response to the financial impact caused by COVID-19. However, the IRS says some payments were sent erroneously and should be returned. For example, an EIP made to someone who died before receipt of the payment should be returned. The entire EIP should be returned […]

June 23, 2020

The CARES Act allows qualified people to take “coronavirus-related distributions” from retirement plans without paying tax. So how do you qualify? You can take up to $100,000 in coronavirus-related distributions made from an eligible retirement plan between Jan. 1 and Dec. 30, 2020. If you repay the distribution to your IRA or plan within 3 […]

June 16, 2020

Traditionally, spring and summer are popular times for selling a home. Unfortunately, the COVID-19 crisis has resulted in a slowdown in sales. The National Association of Realtors reports that existing home sales in April decreased 17.2% from April 2019. Still, many people are selling this year. If you’re one of them, it’s a good time […]

June 9, 2020

If you’re age 65 and older, and you have basic Medicare insurance, you may need to pay additional premiums to get the level of coverage you want. The premiums can be costly, especially if you’re married and both you and your spouse are paying them. But there may be a silver lining: You may qualify […]

June 2, 2020

It’s often hard for married couples to save for retirement when one spouse doesn’t work. An IRA contribution is generally only allowed if you have compensation. However, an exception exists. A spousal IRA allows a contribution to be made for a nonworking spouse. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in […]

May 26, 2020

Many taxpayers with student loans have been hard hit by the economic impact of COVID-19. The CARES Act contains some help. It allows borrowers with federal student loans to stop making monthly payments until Sept. 30, 2020. If you do make student loan payments, you may be able to deduct the interest on your return. […]

May 19, 2020

Did you get an Economic Impact Payment (EIP) that was less than you expected? The federal government is sending EIPs to help mitigate the effects of COVID-19. If you’re under a certain adjusted gross income (AGI) threshold, you’re generally eligible for the full $1,200 ($2,400 if married filing jointly). About the Author Latest PostsAbout James […]

May 12, 2020

You still have time to make your 2019 traditional and Roth IRA contributions. The deadline is generally April 15 but because of the novel coronavirus (COVID-19) pandemic, the IRS extended the deadline until July 15, 2020. If you qualify, deductible contributions to traditional IRAs can lower your 2019 tax bill. Even nondeductible contributions can be […]

May 5, 2020

The coronavirus (COVID-19) pandemic has affected many Americans’ finances. You may have questions about the implications. For example, if your employer is requiring you to work from home, can you claim home office deductions on your tax return? Unfortunately, if you’re an EMPLOYEE who telecommutes, home office expenses aren’t deductible through 2025. What about unemployment […]

April 28, 2020

The coronavirus (COVID-19) pandemic and the ensuing stock market downturn has caused the value of some retirement accounts to decrease. But if you have a traditional IRA, a downturn may provide a valuable opportunity: It may allow you to convert to a Roth IRA at a lower tax cost. Roth IRA qualified withdrawals are tax […]

April 21, 2020

A new IRS tool called “Get My Payment” shows taxpayers either their EIP amount and the scheduled delivery date, or that a payment hasn’t been scheduled. It also allows taxpayers who didn’t use direct deposit to provide bank account details. Some people are getting an error message (“payment status not available”). Hopefully, the IRS will […]

April 14, 2020

In the midst of the coronavirus (COVID-19) pandemic, Americans are focusing on their health and financial well-being. To help with the impact facing many people, the government has provided a range of relief. On its Twitter account, the IRS announced that it deposited the first Economic Impact Payments into bank accounts on April 11. “We […]

April 10, 2020

The CARES Act contains a range of relief, notably the “economic impact payments” that will be made to people under a certain income threshold. But the law also makes some changes to retirement plan rules. The additional 10% tax on early distributions from IRAs and 401(k) plans is waived for distributions made between Jan. 1 […]

April 7, 2020

A new law signed March 27 provides a variety of tax and financial relief to Americans during the coronavirus (COVID-19) pandemic. The CARES Act provides an eligible individual with a cash payment of: $1,200 ($2,400 for eligible married couples filing jointly) plus $500 for each qualifying child. The payment is reduced by 5% of adjusted […]

March 31, 2020

Taxpayers now have more time to file their returns and pay any tax owed because of the coronavirus (COVID-19) pandemic. The IRS announced that the filing due date is automatically extended from April 15, 2020, to July 15, 2020. Taxpayers can also defer making federal income tax payments, due on April 15 until July 15, […]

March 23, 2020

The Governor has directed the Commissioner of Taxes to exercise his authority to provide relief to Vermont businesses who owe Meals and Rooms Tax or Sales and Use Tax until further notice. Many of our local businesses find themselves unable to meet the March 25 and April 25 filing deadlines due to the implementation of […]

March 19, 2020

As you are undoubtedly aware, the country and our community has been coming together in an unprecedented way to contain, reduce and slow the spread of COVID-19. We are encouraged by this cooperation and hoping for the best outcomes possible. With the help and cooperation of everyone in our office, and in our community, we […]

March 17, 2020

If you have a life insurance policy, you probably want to make sure that the life insurance benefits your family will receive after your death won’t be included in your estate. That way, the benefits won’t be subject to the federal estate tax. Under the estate tax rules, life insurance will be included in your […]

March 11, 2020

If you made large gifts to your children, grandchildren or others in 2019, it’s important to determine whether you’re required to file a gift tax return by April 15 (Oct. 15 if you file for an extension). Generally, you’ll need to file one if you made 2019 gifts that exceeded the $15,000-per-recipient gift tax annual […]

March 3, 2020

If you own a home, the interest you pay on your home mortgage may provide a tax break. However, many people believe that any interest paid on home mortgage loans is deductible. Unfortunately, that’s not true. First, you must itemize deductions in order to deduct mortgage interest. And the deduction is limited. From 2018-2025, you […]

February 28, 2020

If you’re a parent, or if you’re planning on having children, you know that it’s expensive to pay for their food, clothes, activities and education. Fortunately, there’s a tax credit available for taxpayers with children under the age of 17, as well as a dependent credit for older children. About the Author Latest PostsAbout James […]

February 18, 2020

Married couples often wonder if they should file joint or separate tax returns. It depends on your individual tax situation. In general, you should use the filing status that results in the lowest tax. But keep in mind that, if you and your spouse file a joint return, each of you is “jointly and severally” […]

February 11, 2020

The tax rules involved in selling mutual fund shares can be complex. If you sell appreciated mutual fund shares that you’ve owned for more than one year, the profit will be a long-term capital gain. As such, the top federal income tax rate will be 20% and you may also owe the 3.8% net investment […]

February 4, 2020

January 28, 2020

Right now, you may be more concerned about your 2019 tax bill than you are about your 2020 tax picture. That’s because your 2019 individual tax return is due to be filed in less than 3 months. However, it’s a good idea to familiarize yourself with tax amounts that may have changed. For example, for […]

January 21, 2020

Many people who used to claim a tax break for making charitable contributions are no longer eligible. That’s because of some tax law changes that went into effect a couple years ago. You can only claim a deduction if you itemize deductions on your tax return and your itemized deductions exceed the standard deduction. Today’s […]

January 14, 2020

The IRS is opening the 2019 individual income tax return filing season on Jan. 27. Even if you usually don’t file until closer to the April 15 deadline (or you file an extension), consider being an early-bird filer this year. It can potentially protect you from tax identity theft. In these scams, a thief uses […]

January 7, 2020

If you save for retirement with an IRA or other plan, be aware there’s a new law that makes several changes to these accounts. For example, the SECURE Act repealed the maximum age for making traditional IRA contributions. Before 2020, traditional IRA contributions weren’t allowed once you reached age 70½. Starting in 2020, an individual […]

January 3, 2020

Technology has made it easier to work from home. However, just because you have a home office doesn’t mean you can deduct expenses associated with it on your tax return. In order to be deductible, you must be self-employed and the space must be used regularly and exclusively for business purposes About the Author Latest […]

December 17, 2019

The number of people engaged in the “gig” or sharing economy has grown in recent years. And there are tax consequences for the people who perform these jobs, such as providing car rides, renting spare rooms, delivering food and walking dogs. Generally, if you receive income from these gigs, it’s taxable. That’s true even if […]

December 10, 2019

If you’re adopting a child, or you adopted one this year, there may be significant tax benefits available to offset the expenses. For 2019, adoptive parents may be able to claim a nonrefundable credit against their federal tax for up to $14,080 of “qualified adoption expenses” for each adopted child. (This amount is increasing to […]

December 3, 2019

You may still have time to reduce your federal tax liability by taking certain steps. For example, contribute the maximum to your retirement plans by year end, including traditional IRAs and SEP plans. Another idea: If you make your Jan. 2020 payment this month, you can deduct the interest portion on your 2019 tax return […]

November 26, 2019

Medical services and prescriptions are expensive. You may be able to deduct some expenses on your tax return but the rules make it difficult for many people to qualify. You may be able to time certain medical expenses to your tax advantage. For 2019, the medical expense deduction can only be claimed to the extent […]

November 19, 2019

When you file your tax return, you do so with one of five filing statuses. It’s possible that more than one status will apply. The box checked on your return generally depends in part on whether you’re unmarried or married on December 31. Here are the filing statuses: Single, married filing jointly, married filing separately, […]

November 15, 2019

Does your business use and accrual-based accounting system? If so, there may still be opportunities to reduce your 2019 tax bill. Read on for 5 ideas on minimizing this year’s tax bill. We’re always here to help, so contact us to learn more about these and other ideas that may reduce your tax burden for […]

November 12, 2019

Does your employer offer a 401(k) or Roth 401(k) plan? Contributing to it is a taxwise way to build a nest egg. If you’re not already socking away the maximum allowed, consider increasing your contribution between now and year end. With a 401(k), an employee elects to have a certain amount of pay deferred and […]

November 6, 2019

There’s a tax-advantaged way for people to save for the needs of family members with disabilities, without having them lose eligibility for government benefits to which they’re entitled. It’s done though an ABLE account, which is a tax-free account that can be used for disability-related expenses. ABLE accounts can be created by eligible individuals to […]

October 29, 2019

Are you charitably minded and have a significant amount of money in an IRA? If you’re age 70-1/2 or older, and don’t need the money from required minimum distributions, you may benefit by giving these amounts to charity. A popular way to transfer IRA assets to charity is through a tax provision that allows IRA […]

October 22, 2019

If you’re planning to sell assets at a loss to offset gains that have been realized during the year, it’s important to be aware of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or […]

October 16, 2019

You may be able to save for your child’s or grandchild’s education with a Coverdell Education Savings Account (ESA). There’s no upfront federal tax deduction for contributions, but the earnings grow tax-free. No tax is due when the account funds are withdrawn, to the extent the amounts don’t exceed the child’s qualified education expenses. Qualified […]

October 8, 2019

Victims of tax-related scams can be contacted through regular mail, phone calls and email. If you receive a text, letter, email or phone call purporting to be from the IRS, keep in mind that the tax agency never calls taxpayers demanding immediate payment using a specific method of payment (such as a wire transfer or […]

October 1, 2019

As we head toward gift-giving season, you may be considering giving cash or securities to your loved ones. Taxpayers can transfer amounts free of gift taxes to their children or others each year through the use of the annual federal gift tax exclusion. For 2019, the exclusion is $15,000 to each person. If you’re married, […]

September 24, 2019

If you own Series EE bonds, check the issue dates on your bonds. If they’re no longer earning interest, you probably want to redeem them. Read this article to learn more on that and how the interest on the bonds is taxed. Contact us if you have questions about the taxability of savings bonds. About […]

September 17, 2019

We all know college is expensive. Fortunately, there are two sizable federal tax credits for higher education costs that you may be able to claim. The American Opportunity credit generally provides the biggest benefit to most taxpayers. It offers a maximum benefit of $2,500. But it phases out based on modified adjusted gross income (MAGI). […]

September 10, 2019

In addition to the difficult personal issues that divorce entails, several tax concerns need to be addressed to ensure that taxes are kept to a minimum and that important tax-related decisions are properly made. For example, if you sell your personal residence or one spouse remains living there while the other moves out, you’ll want […]

September 3, 2019

If you’re self-employed and don’t have paycheck withholding, you probably have to make estimated tax payments. These payments must be sent to the IRS on a quarterly basis. The 3rd 2019 estimated tax payment deadline for individuals is Monday, Sept. 16. Even if you do have some withholding from paychecks or other payments, you may […]

August 28, 2019

As teachers head back for a new school year, they often pay for various expenses for which they don’t receive reimbursement. Fortunately, they may be able to deduct them on their tax returns. However, there are limits on this special deduction, and some expenses can’t be written off. For 2019, qualifying educators can deduct some […]

August 20, 2019

If you’re like many people, you’ve worked hard to accumulate a large nest egg in your traditional IRA (including a SEP-IRA). It’s even more critical to carefully plan for withdrawals from these retirement-savings vehicles. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and managing partner July 1, 2015. He serves […]

August 13, 2019

When a married couple files a joint tax return, each spouse is liable for the full amount of tax on the couple’s combined income. Therefore, the IRS can come after either spouse to collect the entire tax, not just the part that’s attributed to that spouse. This includes any tax deficiency that the IRS assesses […]

August 8, 2019

If you’re lucky enough to be a winner at gambling or the lottery, congratulations! But be aware there are tax consequences. You must report 100% of your winnings as taxable income. If you itemize deductions, you can deduct losses but only up to the amount of winnings. You report lottery winnings as income in the […]

July 31, 2019

Congress created the “kiddie tax” to discourage parents from putting investments in their children’s names to save tax. Over the years, it has gradually affected more families because the age at which it generally applies was raised to children under age 19 and full-time students under age 24 (unless the children provide more than half […]

July 23, 2019

You may have heard of the “nanny tax.” But even if you don’t employ a nanny, it may apply to you. Hiring a housekeeper or other household employee (who isn’t an independent contractor) may make you liable for federal income tax, Social Security and Medicare (FICA) tax and federal unemployment tax. You may also have […]

July 16, 2019

It’s a good time to review your portfolio for tax-saving strategies. The long-term capital gains tax rate is still historically low on appreciated securities that have been held for more than 12 months. The federal income tax rate on long-term capital gains recognized in 2019 is 15% for most taxpayers. However, the top rate of […]

July 9, 2019

Are you a volunteer who works for charity? You may be entitled to some tax breaks if you itemize deductions on your tax return. Unfortunately, they may not amount to as much as you think your generosity is worth. Because donations to charity of cash or property generally are tax deductible for itemizers, it may […]

July 2, 2019

June 25, 2019

June 18, 2019

A Health Savings Account (HSA) offers tax-advantaged funding of health care costs. If you have a qualified high-deductible health plan, you can contribute to an HSA sponsored by your employer or set up by you. You own the account, which can bear interest or be invested. It can grow tax-deferred, similar to an IRA. Withdrawals […]

June 11, 2019

June 4, 2019

May 28, 2019

The IRS just released its audit statistics for the 2018 fiscal year, and fewer taxpayers had their returns examined compared with prior years. Overall, just 0.59% of individual tax returns were audited (down from 0.62% in 2017). This was the smallest number of audits conducted since 2002. However, even though a small percentage of returns […]

May 21, 2019

Did you receive a refund this year that was smaller than you were expecting? Or did you wind up owing additional tax when you filed your return? That might mean it’s time to check and adjust your withholding. This might be necessary due to changes in the Tax Cuts and Jobs Act or because something […]

May 18, 2019

Sometimes professional valuators tweak financial statements before using them to appraise a business. Three common types of adjustments include normaling, nonrecurring and nonoperating items, and discretionary spending. About the Author Latest PostsAbout James B. ReynoldsJim became a partner in 1991 and managing partner July 1, 2015. He serves as the manager of the Firm’s Accounting […]

May 14, 2019

Depending on where you live, you may see “for sale” signs dotting the landscape. Spring and summer are the optimum seasons for selling a home. So it’s a good time to review the tax implications. If you’re selling your principal residence, you can exclude up to $250,000 ($500,000 for joint filers) of gain, so long […]

May 7, 2019

Are you wondering where your tax refund is? According to the IRS, most refunds are issued in less than 21 calendar days. If you’re curious about when yours will arrive, you can use the IRS “Where’s My Refund?” tool. Go to https://bit.ly/2cl5MZo and click “Check My Refund Status.” In some cases, taxpayers may be notified […]

April 30, 2019

If you’re interested in purchasing an electric or hybrid vehicle, you may be eligible for a federal tax credit of up to $7,500. (Depending on where you live, there may also be state tax breaks.) However, the federal credit is subject to a phaseout rule that may reduce or eliminate the tax break based on […]

April 24, 2019

The rules for writing off personal casualty losses on a tax return have changed for 2018 to 2025. Specifically, taxpayers generally can’t deduct losses unless the casualty event qualifies as a federally declared disaster. (The rules for business or income-producing property are different.) Another factor that now makes it harder to claim a casualty loss […]

April 19, 2019

Are you either a business owner or self-employed? Are you travelling in the U.S.? Is business the primary reason for your trip? If yes to all three, transportation costs to and from your business activity location and out-of-pocket expenses for business days can be 100% deductible. Rules and limits apply. Contact us with questions. About […]

April 16, 2019

After filing a tax return, you may have questions. 1. Where’s my refund? Go to irs.gov and click on “Refund Status” to find out. 2. How long must I save tax records? You should generally save them for 3 years after filing (although keep the actual returns indefinitely). But there are exceptions to this general […]

April 9, 2019

Medicare premiums and supplemental insurance can be more expensive than seniors expect. However, some taxpayers may be able to lower their tax bills by deducting Medicare premiums and other qualifying medical expenses. However, it can be difficult to qualify to claim medical expenses on your tax return. For 2019, you can deduct medical expenses only […]

April 3, 2019

You still have time to make your 2018 traditional and Roth IRA contributions. The deadline for most taxpayers is April 15, 2019. If you qualify, deductible contributions to traditional IRAs can lower your 2018 tax bill. Even nondeductible contributions can be beneficial because of tax-deferred growth. The 2018 contribution limit is $5,500 (plus $1,000 for […]

March 27, 2019

If you participate in a qualified retirement plan, such as a 401(k), you must generally begin taking required minimum distributions (RMDs) no later than April 1 of the year after which you turn age 70½. The penalty for withdrawing less than the RMD is 50% of the portion that should have been withdrawn but wasn’t. […]

March 26, 2019

Installing renewable energy systems in your primary or other residence? You may be eligible for a valuable tax break. if your home improvements qualify, the Nonbusiness Energy Tax Credit can reduce your federal tax bill, dollar-for-dollar, by a percentage of your energy equipment and labor costs. About the Author Latest PostsAbout James B. ReynoldsJim became […]

March 19, 2019

March 12, 2019